Private equity is at a crossroads in 2024. The boom-time days are waning, giving way to a sea of change across the industry.

Deals are more expensive. Exits are being postponed. And with investors looking for transformation, not stabilization, buyer-seller expectations have become misaligned.

The clear evidence? As of December 15, 2023, private equity firms are sitting on $2.59 trillion of dry powder, according to S&P Global Market Intelligence.

Now, there’s a distinct shift in what it takes to see double-digit returns. In 2024, the path ahead seems clearer for private equity firms. It’s time to get that return value.

More firms are leaning into value-creation initiatives

While value creation isn’t new, more and more PE firms are relying on new initiatives to strengthen their strategic plans.

It makes sense. Businesses have already cut operating costs, interest rates are high and likely not dropping significantly anytime soon, and valuations have dropped across sectors. Private equity firms know they need to get more involved to generate returns in this difficult market.

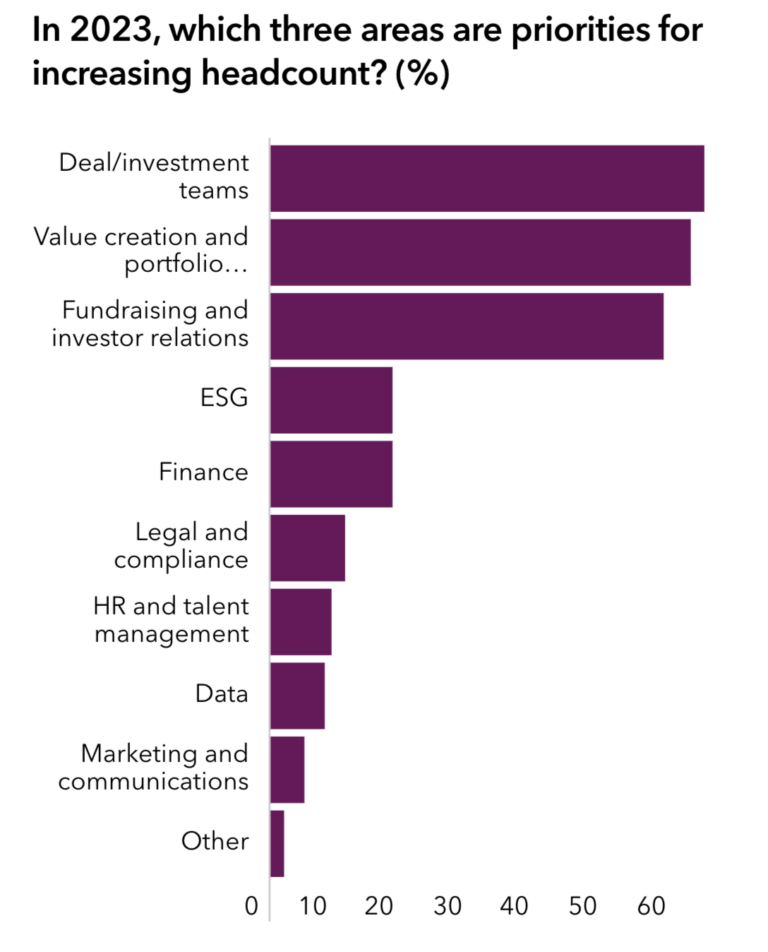

We see the increased demand for value creation in the hiring environment as well. While hiring may be slowing down overall in the PE sector, demand for value-creation professionals remains high.

The demand for operating professionals tells us that more and more firms are diving in deep with their portfolio companies and working to design and enact performance improvement initiatives that increase profitable growth.

There are two tactics for maximizing growth at the operational level:

- Identify the most profitable segments within the business and double down.

- Restructuring and optimizing business segments that aren’t as profitable.

To do this, private equity firms need to improve their visibility. This leads us to the next phase of the industry’s evolution.

Firms are doubling down on data visibility

How can you pull the right levers when you don’t know which levers to pull? Visibility from a broad perspective will help you ensure you have insights across all your portfolio companies and enable you to drill down for margin optimization opportunities.

Collecting all the data needed for due diligence and high-level performance insights is time-consuming and bespoke. While Operating Partners (OPs) know this, the solution tends to be adding more data to spreadsheets — but that’s not a viable fix. It’s not scaleable or repeatable. And that’s a problem for the OPs.

Enhancing data infrastructure is a top priority for private equity firms aiming to transform raw data into actionable insights. The focus isn’t solely on amassing vast quantities of data — it’s on ensuring its quality, relevance, and accessibility across portfolio companies through robust governance frameworks.

OPs are searching for ways to partner with their portfolio companies, compare apples to apples, and truly diagnose the problems down to the unit, salesperson, or service level. They’re not operating from objective data-rich environments, and value-creation strategies go out the window. Without visibility, they don’t know which lever to pull to increase margins and drive profitability.

Private equity firms know that data is their superpower. They know they need this influx of information, but over the next few years, there will be more data refinement and process sophistication. You’ll need more meaningful data to diagnose the problems and become more profitable.

Where private equity firms have an opportunity is the aggregation of data across their related portfolio companies. For instance, they can use data to understand customer profile characteristics to penetrate new markets or better serve existing ones, compare and consolidate vendors, and eliminate inefficiency and cost across business processes.

Making marginal improvements for better profit margins

Today’s economic climate makes the current value creation strategies obsolete—or at least reduce them to only a part of the profit margin success strategy. Pulling the same levers as before won’t get portfolio companies to double-digit returns.

Within this context, private equity buyers must leverage more influential value-creation mechanisms to reliably surpass benchmarks. This approach requires data to fuel fact-based decisions on everything from AP/AR processes to business process optimization.

The smaller optimizations will impact cash flow management and overall profitability. Take, for instance, a deeper look at invoicing practices. Addressing seemingly small errors like a broken integration that forces your team to manually enter information can not only speed the invoicing process and improve cashflow, but it can also lead to a better customer experience. Through such granular improvements, private equity buyers can transform seemingly minor process issues into major levers for value creation and financial performance.

A flight to quality

To mitigate risk in the uncertain market, investors are seeking larger and more proven private equity firms to invest in. LPs are scaling down on new commitments, particularly with funds in their vintage year. Dollars raised by funds under $5 billion decreased by 28%, and first-time fund launches also decreased by 40% in 2022, laying the foundation for 2023 performance.

LPs and the industry are more risk averse than in recent years. Investors are showing a preference for a flight to quality, opting to allocate capital to funds that have demonstrated resilience and consistent performance across various market cycles.

For the larger, more established firms, while this trend may bring an influx of capital, it also comes with heightened expectations. Investors aren’t just looking for stability—they are seeking active value creation and strategic guidance to navigate the uncertain market. Firms must be proactive in demonstrating their value and building trust with their LPs.

This investor shift indicates greater transparency, robust reporting, and clear communication of the firm’s strategy and value-creation initiatives. Firms have the opportunity to invest in advanced analytics and reporting tools that provide LPs with real-time insights and performance data. This ensures they remain well-informed and confident in the firm’s ability to manage their investments effectively.

Private equity is facing a sea change

We haven’t seen monetary policy and interest rates like this in nearly a generation. The changes facing the industry dive much deeper than the ones mentioned here. Despite the uncertainty, some tools can give private equity firms the edge — and help mitigate the risk inherent in the industry.

Chassi streamlines operations and fund management, reducing costs, improving margins, and enabling profitable decision-making across your portfolio.

Chassi’s AI-powered process intelligence application visualizes critical financial and operational insights in real time. You’ll have detailed data across your portfolio companies at your fingertips to make the strategic changes to drive profit margins and ultimately see returns.

Make Chassi one of the most valuable tools in your value creation toolbox.