Discover, measure, and prioritize with purpose

Chassi delivers objective, finance-grade insight into what drives EBITDA, cash, and durability. The platform builds one operational truth across sales and finance, then ranks what to fix first.

Speed to clarity

Connect systems, see pathways, and get quantified findings in days so you can move faster on cash and growth.

Trust the numbers

Data comes from systems of record with lineage from booked to billed to paid. Multi-entity support makes reporting comparable across subsidiaries.

Continuous improvement

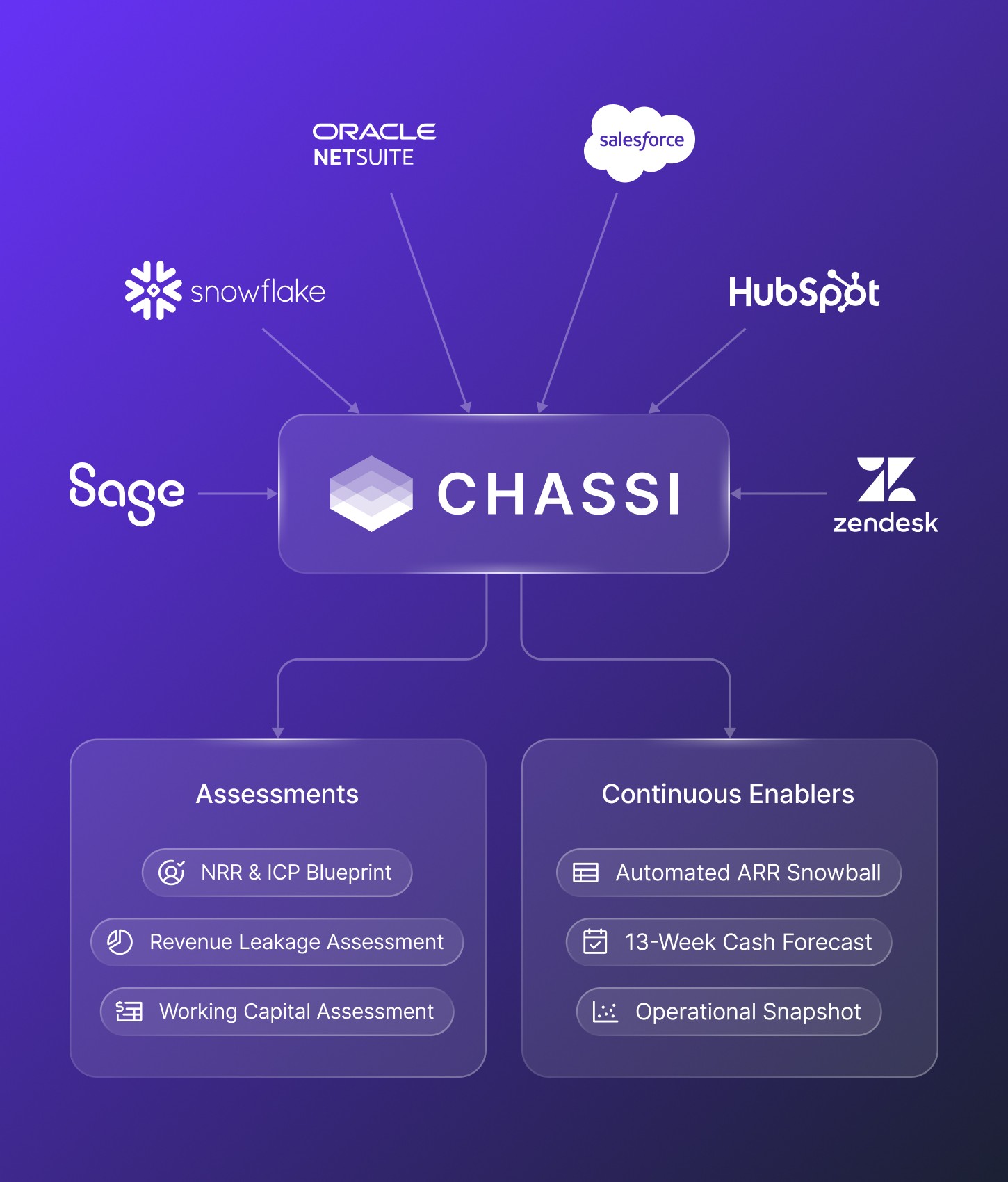

Track the effect of changes over time. Move from one-time insight to ongoing reporting with Automated ARR Snowball, 13-week cash, and Operational Snapshot.

An MRI for your core processes

Get a clear view of how work actually flows. Pinpoint bottlenecks, quantify impact, and turn fixes into measurable outcomes.

Pathways

Get an objective view in a matter of minutes. See how your workflows really function, and measure every variation. Easily filter and focus on critical areas to analyze what matters most.

Cycle time analysis

Know where time is lost between steps and what caused it. Quickly spot outliers and dive deeper for immediate insights.

At a glance

Create checkpoints and see average cycle times instantly. Spot bottlenecks and compare to SLAs to focus teams on the highest-impact work.

Work analysis

See where rework happens and why fields change. Identify manual edits and steps that drive exceptions.

Reporting

Turn operational truth into board-ready views. Mix tabular and graphical trends, segment by entity or product, and export cleanly.

DSO simulator

Quantify the cash impact of taking days out of specific O2C steps. Test scenarios before you change policy or process.

One operational truth across your stack

Chassi “sits above” ERP, CRM, billing, support, and product-usage systems to unify Lead-to-Cash. It produces actionable findings and live reporting like Snowball, 13-week cash, and exception tables.

Choose your path to operational clarity

Pinpoint bottlenecks, quantify impact, and turn fixes into measurable outcomes.