Company Stats

| Industry | HR software |

|---|---|

| Revenue | $75M— Keystone (business unit) |

| Size | 10,000+ Customers |

Level of Effort

| Installation | 45min |

|---|---|

| Zeta/Keystone’s Time | 5hrs |

| In-App Analysis | 15hrs |

Results

- Prevented $14M in Churn Risk

The Challenge

Fragmented channels, hidden churn risk

Zeta Corp., a fast-growing SaaS company backed by private equity, manages a diverse portfolio spanning four business units and multiple sales channels. With substantial investment at stake, maintaining consistent revenue growth and retention was a critical priority.

The Ask

Identify risk and unlock upsell

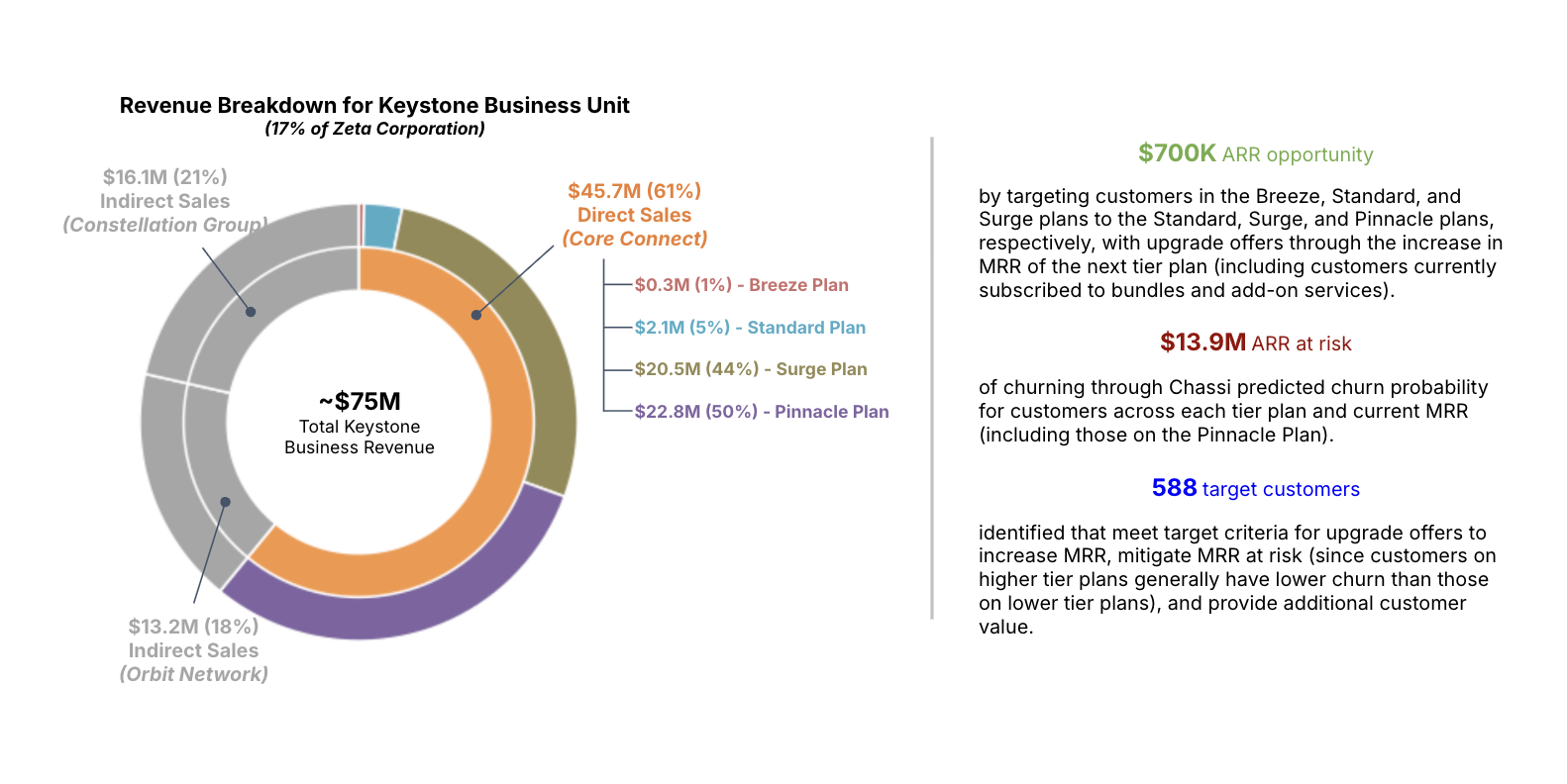

Zeta’s CFO and the fund’s operating team tasked Chassi with rapidly identifying at-risk customer segments and uncovering immediate revenue opportunities within one targeted business unit, Keystone, that sells through direct and indirect channels and represents 17% of their total operations.

Goals

- Pinpoint exact areas of churn risk with data-driven clarity

- Identify actionable upsell opportunities hidden in customer behavior

- Provide specific, immediate insights without internal disruption

Chassi's Approach

From raw data to risk map in hours

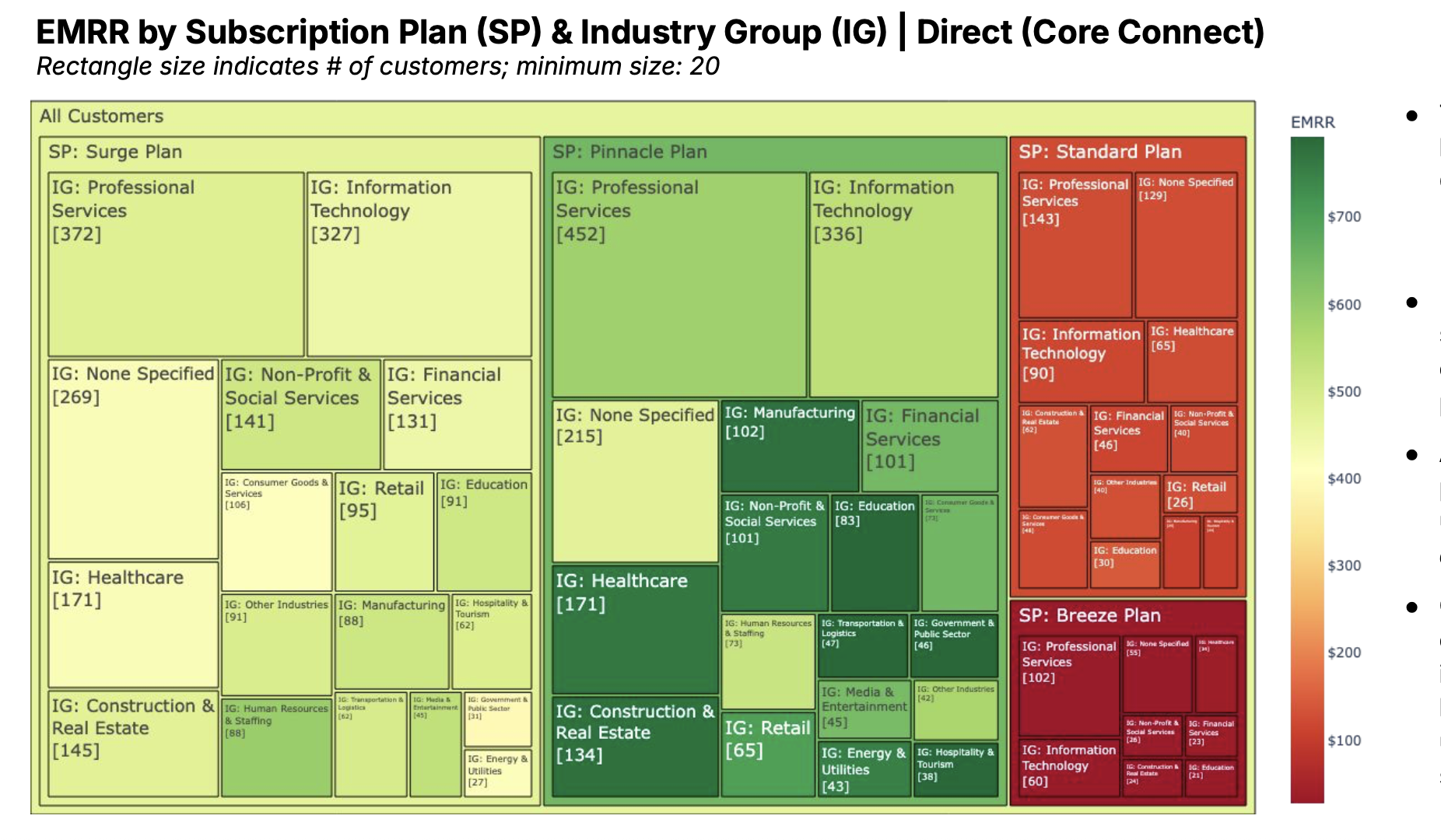

Leveraging Chassi’s AI-powered platform, we directly ingested transactional data from Keystone’s CRM and ERP systems, quickly modeling a comprehensive Lead-to-Cash process. Within hours, the platform segmented customers by MRR, sales channel, subscription type, and industry, overlaying churn indicators, usage patterns, and sales performance.

Key Findings

$13.9M ARR at risk; $700K upsell

- Targeted revenue risk: Uncovered $13.9M in high-risk ARR concentrated within just one sales channel (~19% of total ARR)

- Immediate revenue opportunity: Identified a rapid-action upsell potential of $700K ARR within the same narrow scope

- Precise customer segmentation: Delivered clear, actionable customer segments indicating both risk and upsell potential, enabling targeted interventions

Why It Mattered

Protecting EBITDA and exit value

Churn prevention is more than defensive; it’s fundamental to portfolio company growth and exit valuation. By quickly isolating Keystone’s at-risk revenue and aligning targeted upsell strategies, Chassi provided Zeta Corp. with immediate, impactful levers to secure millions in revenue. This proactive strategy directly contributes to stronger EBITDA and significantly improved investor outcomes.

Looking forward

Portfolio-wide rollout next

Encouraged by immediate results with Keystone, Zeta Corp. and the operating team plan to expand the assessment across all remaining sales channels in H2, 2025, and all business units in 2026. This comprehensive visibility positions them to mitigate further churn risks and systematically capture hidden growth opportunities, ensuring sustained valuation growth throughout the hold period.

Ready to see these results for yourself? Let’s start with a conversation.

Schedule your personalized demo today: