Company Stats

| Industry | Industrial automation technology |

|---|---|

| Revenue | $250M |

| Size | 15,000+ Customers |

Level of Effort

| Installation | 15min |

|---|---|

| Iota’s Time | 3hrs |

| In-App Analysis | 15hrs |

Results

- Identified $21M in Revenue Leakage

Client Snapshot

Preparing for exit by improving revenue accuracy

Iota is a PE-backed provider of industrial automation technology, serving SMB, Commercial, Enterprise, Indirect, and Public Sector clients. With annual revenue around $250M, the company was preparing for a strategic exit in 2026. To maximize valuation and EBITDA, the CFO and PE operating team prioritized identifying and addressing revenue leakage.

Project Scope

Identifying hidden sources of revenue loss

Iota’s leadership engaged Chassi to assess and quantify leakage across recurring (subscription-based) and nonrecurring (hardware and one-time services) revenue streams. The objective: confirm billing accuracy, quantify any gaps, and highlight immediately actionable opportunities to optimize processes—all without disrupting ongoing operations.

Goals

Clear objectives, tangible outcomes

- Quantify actual revenue leakage across recurring and nonrecurring revenue streams.

- Identify root causes of leakage, particularly in billing gaps, cancellations, and credit memo issuance.

- Pinpoint business units and customer segments most vulnerable to revenue leakage.

- Deliver actionable insights to optimize operational cash flow and enhance exit readiness.

Chassi's Approach

Seamless integration and rapid visibility

Chassi rapidly connected directly to Iota’s CRM (Salesforce) and ERP (NetSuite), securely ingesting transactional data without manual intervention or operational disruption. Leveraging advanced AI and data analytics, Chassi immediately visualized Iota’s real-world revenue recognition processes, highlighting variances, inconsistencies, and hidden gaps.

The analysis provided granular insights into:

- Booking-to-invoice discrepancies.

- Improper credit memo usage and issuance.

- Leakage hotspots segmented by customer type and business unit.

The Outcome

Results (within 2 weeks)

Quantified leakage and actionable insights

Chassi rapidly identified $47M in potential revenue leakage across recurring and nonrecurring streams. Of this, $21M represented genuine operational leakage from avoidable issues like improper credit memos, unexplained write-offs, and billing inaccuracies.

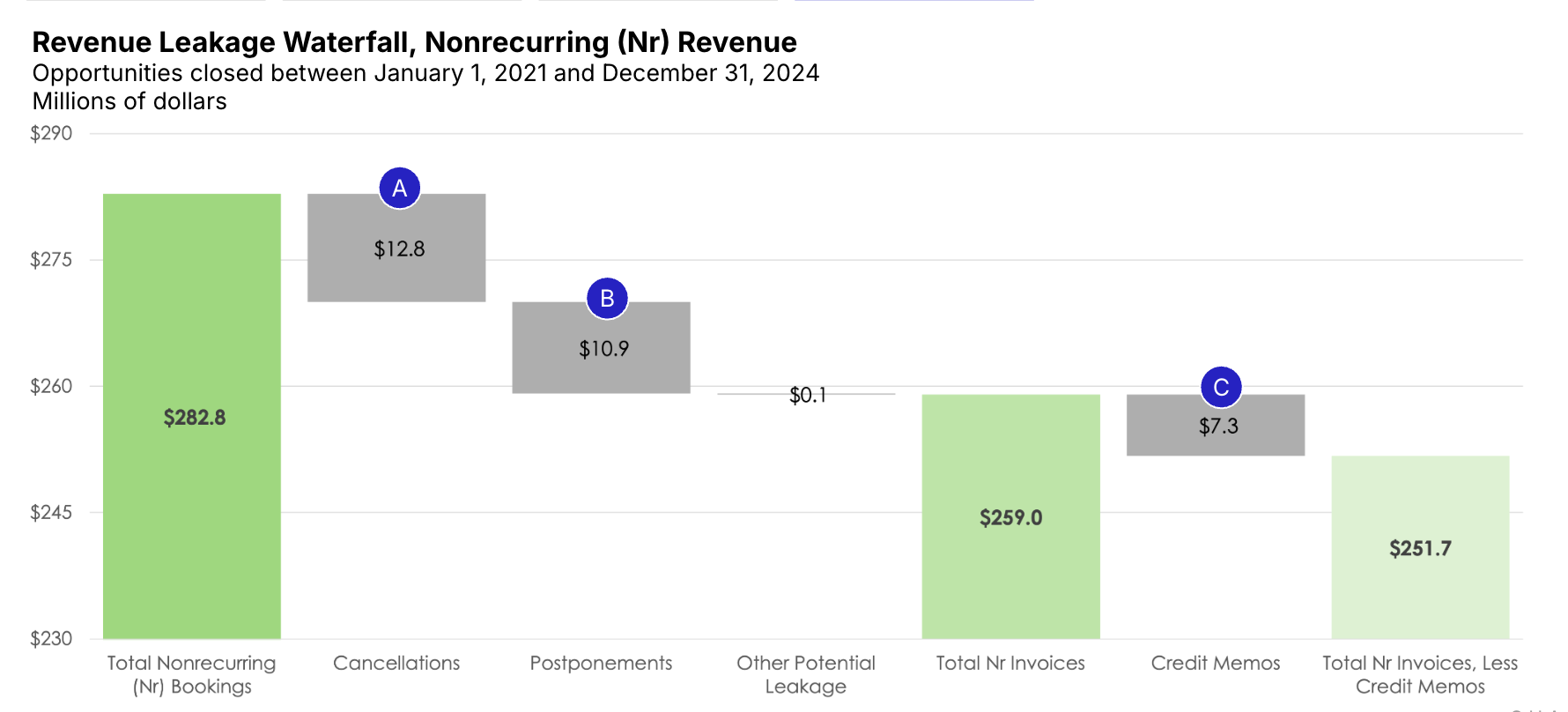

Booking-to-Billing gap analysis

Identified a $23.8M gap between booked and invoiced revenue, primarily driven by cancellations ($12.8M) and postponed deployments ($10.9M). Though not strictly leakage, these gaps significantly impaired revenue predictability and financial planning accuracy.

In-depth credit memo examination

Analyzed $47.6M in total issued credit memos, identifying approximately $21M as avoidable revenue leakage, notably due to:

- Excessive use of customer courtesy credits.

- Write-offs increasing at an alarming 68% annual growth rate.

- Unexplained or undocumented credit memos.

Segmented revenue leakage insights

Pinpointed SMB and Indirect segments as the largest leakage contributors, guiding targeted operational improvements and risk mitigation efforts.

Why It Matters

Turning leakage into improved valuation

By quickly quantifying leakage and revealing operational blind spots, Chassi provided Iota with precise, actionable insights. These findings enabled leadership to rapidly enhance financial discipline, reduce ongoing revenue loss, and materially improve EBITDA—all critical for maximizing enterprise value during an upcoming exit.

Looking forward

A sustainable path to profitability

Following Chassi’s insights, Iota’s finance and operational teams are proactively tightening billing processes, reforming credit memo practices, and addressing booking inefficiencies. This assessment provided immediate revenue recovery opportunities and set the stage for sustainable profitability improvements, laying the foundation for a stronger exit valuation.

Ready to see these results for yourself? Let’s start with a conversation.

Schedule your personalized demo today: