Focusing on reducing the parts of your DSO within your control will mean happier customers, more working capital, lower credit risk, and, honestly, more peace of mind.

Time is money. The saying is always true, but when it comes to your cash conversion cycle, it becomes literal.

The longer your Days Sales Outstanding, the more money you leave sitting on the table and the higher the risk of never seeing it at all. But getting that money in faster usually means pestering your customers until they pay you. Rock, meet hard place.

You can automate emails (with an increasingly stern tone) to send at 15, 30, 45 days past due. But here’s the thing, you’re trying to wrangle something that’s completely outside of your control.

So why not focus on what you can control?

There’s a whole produce aisle full of ripe improvement opportunities before the invoice even leaves your system.

This goes for companies that use FinTech for automated payments as well. If you’re in this boat, you may be wondering, “How else can we bring cash in faster when our DSO is already the best it can be?”

Look internally. There are plenty of opportunities to gain more control over the process upstream and reap the benefits downstream.

Keep reading to see how to add all of those low-hanging fruits to your cart.

What is DSO, and why is it so important to measure?

Days Sales Outstanding is the average number of days it takes your business to collect payment for a sale. You know, how fast you get paid. It’s a way to measure the business’ efficiency and forecast cash flow.

DSO is also one of the three main metrics that make up your cash conversion cycle along with Days Payable Outstanding, which is the average time it takes you to pay vendors, and Days Inventory Outstanding, which is the average time it takes you to turn your inventory into sales.

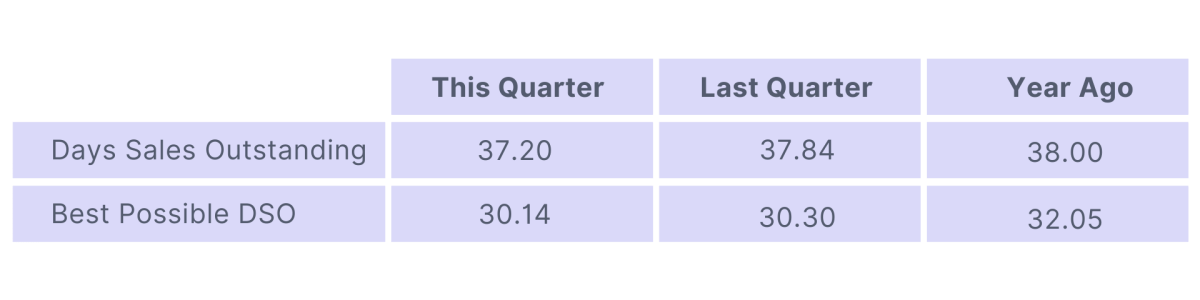

But what does a “good” DSO look like? The best possible DSO across industries was 30.14 days in the first quarter of 2022, according to the National Summary of Domestic Trade Receivables Results Summary by The Credit Research Foundation. The mean was 37.20 days, which was slightly better than the results from Q4 in 2021, 37.84 days. Across the board, it looks like DSOs are trending down. And it makes complete sense.

Regardless of your industry, this is true: The shorter your DSO, the more cash you actually get in the door. And sooner.

Shortening your DSO means you have as much working capital as possible, something that’s especially important in this macro environment. And with more working capital comes lower credit risk.

But before you can improve your DSO, you’ve got to know where it stands to begin with.

How do you traditionally calculate DSO?

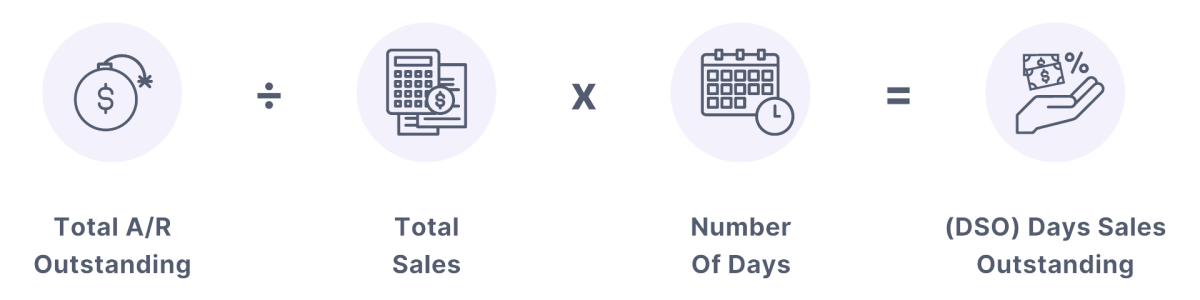

Calculating DSO isn’t actually that complicated.

Here’s the standard formula: Divide your accounts receivable by your total credit sales and then multiply that by the number of days in the period.

We made an easy calculator, so you can add your numbers and see what your current DSO is.

But if you’re like us and you learn by doing, here’s an example:

Let’s say you’re looking at your DSO for a 365-day fiscal year. You had $500,000,000 in total sales for the year and average accounts receivable of $100,000,000 for the year.

You divide your average AR by your total sales and get 0.2. Multiply that by 365 (the number of days in the given period), and you get 73. So your DSO is 73 days.

If you break it down, a majority of those 73 days probably consist of you waiting for a customer to pay an invoice. But what if you started improving your DSO before that invoice left your hands? (Metaphorically, of course. Who hands people invoices anymore?)

Isn’t there a different way to measure DSO?

Traditionally, DSO improvements have been focused on the time it takes for your customers to actually send you payment.

But there are a few problems with that.

For one, there’s not much you can do once the invoice goes out besides harassing and maybe mildly threatening your customers.

That’s like trying to improve how fast the checkout line moves at, say, Trader Joe’s. You can politely ask the TJ’s crew member not to compliment every item someone buys, you can crane around the person in front of you to estimate how long it’ll take to scan everything in their cart, and you can increase the beat of your foot tapping. But ultimately, that’s not going to speed anything up. It’s just going to bug you and everyone nearby more.

It also completely ignores the part of your DSO that your team can control: handoffs, approvals, automation, etc.

That controllable part is called Operational DSO. It measures how long your internal team takes to get the invoice out the door. And you can start improving that today.

How do you reduce your Operational DSO?

Regardless of your industry or the size of your business, you can use these steps to shorten the time sales orders, and invoices are sitting in a manual approval queue or ping-ponging back and forth between sales ops and finance. And that means getting paid faster.

1. Cycle time analysis

- Start by understanding how long it takes your team to complete each step of the process, from closing the deal in your CRM to sending the invoice. Those cycle times are now your benchmarks.

2. Reduce rework and manual work

- In those areas with extra long cycle times, look at which fields or details on order are being worked or touched the most. These are low-hanging fruit, easy opportunities to start improving.

3. Identify root causes

- Zoom out a bit and look at the common threads between these delays and wasted work. This is the perfect time to make sure you’re using NetSuite or any other system to its fullest too.

- Once you find the root causes of issues, you know where to start improving.

4. Automate

- The key to successful automation is a thorough, clear understanding of your as-is processes. So once you hone in on those root causes and prioritize which one hurts the most, decide where automation could help.

- Of course, automation isn’t the end-all-be-all solution. Sometimes additional training, service level agreements, and good ol’ change management could be the solution. More often than not, it’s D) All the above.

5. Improve

- It’s funny how one simple word can encapsulate so much complexity. But once you know exactly where to improve and have a few tools (automation, SLAs, additional training, a process intelligence tool like Chassi) to help you do so, the heavy lift is just making sure it actually happens.

6. Repeat

- This is the most important step. Making lasting change in any process is not a one-time project.

- Use the benchmarks you created in step one to measure how the changes are working over time and make adjustments as your business evolves.

Now, you can start today

Did you notice how not one of the steps listed above involves reaching out to your customers?

Pouring all of your efforts into the hazy void after the invoice leaves your system only focuses on half the problem.

There are countless improvements you and your team can start making internally today to shave days off your DSO.

We won’t say it’s as easy as grabbing a pre-made salad from the refrigerated section, but at least you’ve got the daunting part of figuring out where to start.

And if you need a little carrot of motivation or validation, try out our DSO calculator to see what you have to gain in additional working capital with every day of DSO you reduce.