Epsilon Enterprises unlocks $4.5M in hidden free cash flow potential with Chassi

Using Chassi’s AI-powered operational analytics platform, Epsilon Enterprises uncovered significant opportunities to increase free cash flow and paved the way for a successful exit.

4 min read

Company Stats

| Industry | Enterprise accounting |

|---|---|

| Revenue | $100M-250M |

| Size | ~1,500 customers ~300 employees |

Level of Effort

| Installation | 15min |

|---|---|

| Epsilon’s Time | 3hrs |

| In-App Analysis | 15hrs |

Results

- Identified $4.5M in Free Cash Flow (FCF) potential

The Rundown

Maximizing cash flow for a successful exit

Leading enterprise accounting software company Epsilon Enterprises* (EE) operates through four subsidiaries (Cerberus, Medusa, Chimera, and Hydra). Six years after being acquired by a private equity fund, EE is preparing for a planned exit.

To make this transition as smooth and profitable as possible, the EE team wants to maximize cash flow through the reduction of Days Sales Outstanding (DSO) and expansion of Days Payable Outstanding (DPO).

Enter Chassi. Over a two-week period, and only taking three hours of Epsilon’s time Chassi found $4.5 million in free cash flow potential through strategic Order-to-Cash and payables optimization across its subsidiaries.

Here’s how Chassi increased Epsilon Enterprise’s free cash flow.

The Challenge

Tackling receivables and payables for optimal performance

As a PE-owned SaaS company, Epsilon Enterprises needed to increase liquidity and boost cash reserves in anticipation of an upcoming exit. The EE team utilized Chassi to spearhead this critical initiative by examining both receivables and payables with the Chassi platform.

Strategic goals aligned:

- Decrease DSO: Reduce DSO in select categories and subsidiaries to ensure faster cash collection.

- Establish AR benchmarks: Create performance benchmarks within the Order-to-Cash process to mitigate the risk of underperforming segments.

- Optimize bill payments: Refine the approach to accounts payable to increase free cash flow.

Here are the steps Chassi took to visualize and diagnose EE’s opportunities to improve DSO and free up cash flow.

- Step 1: Install Chassi into their ERP to model receivables and payables processes for real time analysis

- Step 2: Utilize Chassi to extract and visualize data for key steps in both the receivables and payables process

- Step 3: Chassi analyzed trends within each step of the process and considered both the complexity and value of reducing the cycle time of each step in isolation

The Findings

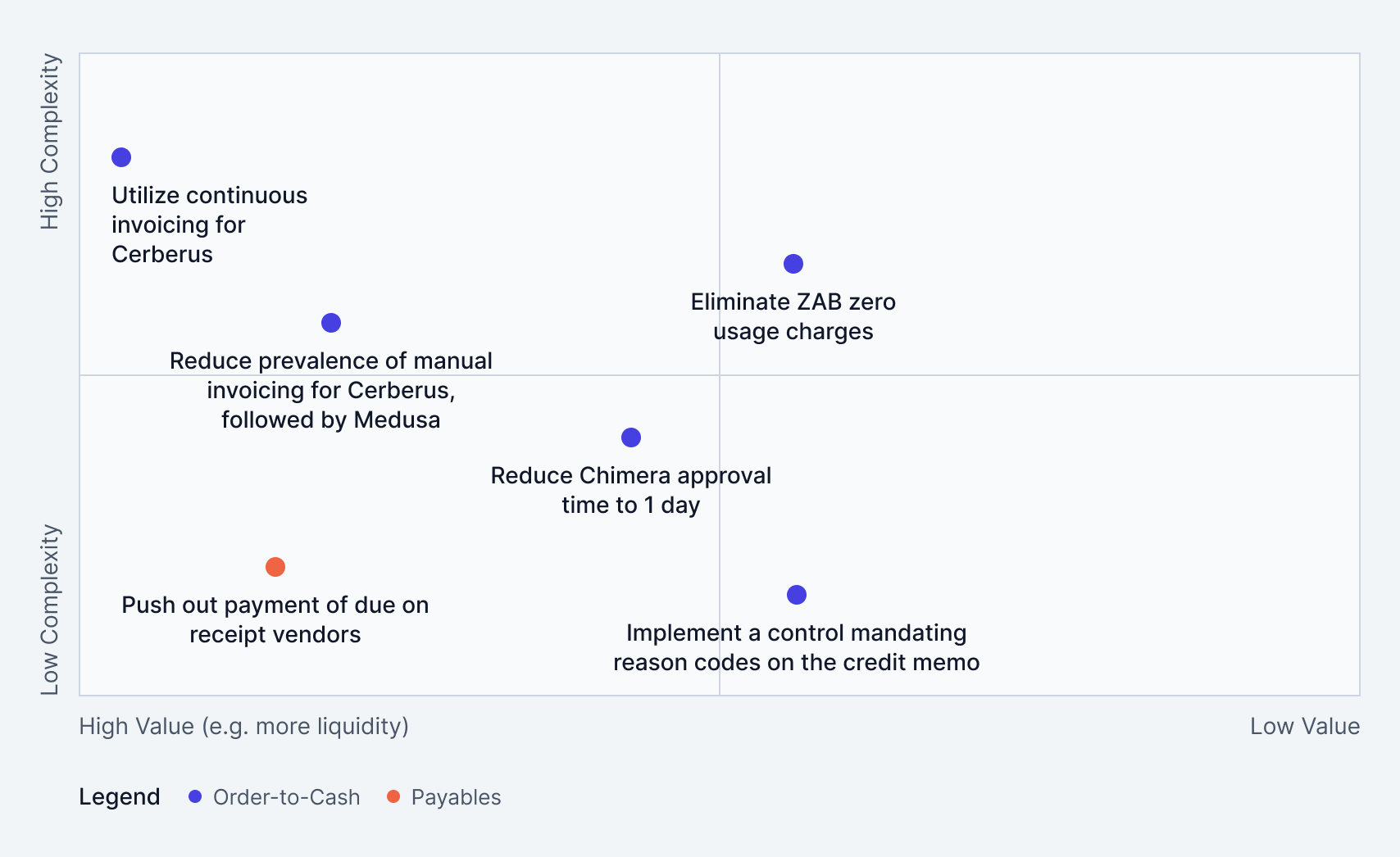

Pinpointing high-impact, low-complexity fixes

Chassi’s in-depth analysis of Epsilon Enterprises’ processes, from book to receipt of payment, revealed several key opportunities for improvement within the Order-to-Cash cycle. Additionally, a broad examination of the accounts payable process and terms performance highlighted further areas for optimization.

Chassi provided comprehensive insights to increase value creation by:

- Increasing free cash flow

- Increasing efficiency

- Mitigating risk

Chassi identified these opportunities to unlock cash flow with process standardization, automation, and additional improvements.

| Process | Insights Identified with Chassi | The Fix | Potential Cash Flow Increase |

|---|---|---|---|

| AR | The Cerberus subsidiary has a much longer than average book-to-bill time relative to other subsidiaries | Switch from batch invoicing to continuous invoicing | ~$1.9M |

| AR | Cerberus and Medusa subsidiaries frequently use manual invoicing, which takes ~8 days longer on average and ~9 days longer by median to be collected than their automatic counterparts | Prioritize the reduction of manual invoicing down to 50% for Cerberus, then Medusa | ~$900K combined |

| AR | Chimera has the longest approval times on average at ~4d 17h; all other subsidiaries have an invoice approval time of less than a day | Reduce Chimera approval time to 1 day | ~$575K |

| AP | 61% of invoices are “due on receipt” and paid within 15 days | Push “due on receipt” payments to 30 days for all vendors | ~$1.1M |

| AR | The ZAB module appears to create extra charges for zero usage, which can slow or cause downtime in NetSuite | Eliminate ZAB zero usage charges and implement a control mandating reason codes on the credit memo | N/A (efficiency improvement) |

| AR | ~28% of all Epsilon credit memos are “blank” for the reason code | Investigate affected subsidiaries and implement a control mandating reason codes on the credit memo | N/A (mitigation of risk) |

The Results

$4.5M of free cash flow unlocked

Implementing these findings unlocked an expected $4.5 million in free cash flow for Epsilon Enterprises, making them more attractive to potential buyers and enhancing the overall exit strategy.

Chassi’s approach didn’t just identify the problems quickly; it also highlighted their value and complexity, recommending Epsilon prioritize high-liquidity, low-complexity initiatives. This was all achieved with just three hours of Epsilon’s time, no further strategic context, and 15 hours of in-app analysis and deliverable creation.

Enhanced liquidity and operational efficiency make Epsilon more attractive to buyers, potentially driving a higher valuation and smoother transition. But the benefits don’t stop here.

Chassi’s platform can dive into other critical areas, offering even more opportunities to enhance efficiency and drive growth:

- Revenue Leakage

- Recurring Revenue

- Integrations & Performance

- Sales Efficiency

Now, imagine the possibilities for your business when you extend Chassi’s powerful insights across all these areas. Epsilon unlocked tremendous value at a pivotal time in their fund lifecycle with minimal effort. What will your business achieve when you start now?

Ready to see these results for yourself? Let’s start with a conversation.

Schedule your personalized demo today: