Unlocking $7.4M in Free Cash Flow at Kappa Corp.

Kappa Corp. is a PE-backed B2B SaaS company specializing in enterprise data infrastructure, operating across seven subsidiaries and serving over 27,000 active customers. As the company prepares for a 2026 exit, improving cash flow and financial predictability became a top priority.

3 min read

Company Stats

| Industry | Enterprise data |

|---|---|

| Revenue | $80M-100M |

| Size | 27,000+ Customers |

Level of Effort

| Installation | 15min |

|---|---|

| Kappa Corp.’s Time | 3hrs |

| In-App Analysis | 15hrs |

Results

- Identified $7.4M in Free Cash Flow (FCF)

The Challenge

Tackling high DSO and lack of visibility

Despite a recent ERP transition and improvements in financial reporting, Kappa continued to experience elongated cash conversion cycles. Days Sales Outstanding (DSO) remained high, and leadership lacked clear insight into where the breakdowns occurred across subsidiaries and customer segments.

The finance team suspected inefficiencies in the invoicing process, but didn’t have the tools or capacity to trace the problem across systems or regions.

The Ask

Pinpointing high-impact, low-complexity fixes

Kappa’s CFO, with the help of the operating partner, engaged Chassi to:

- Identify opportunities to accelerate cash conversion

- Surface specific delays in the order-to-cash cycle

- Provide actionable insights with no lift from internal teams

Chassi's Approach

Actionable insights within the first 2 weeks

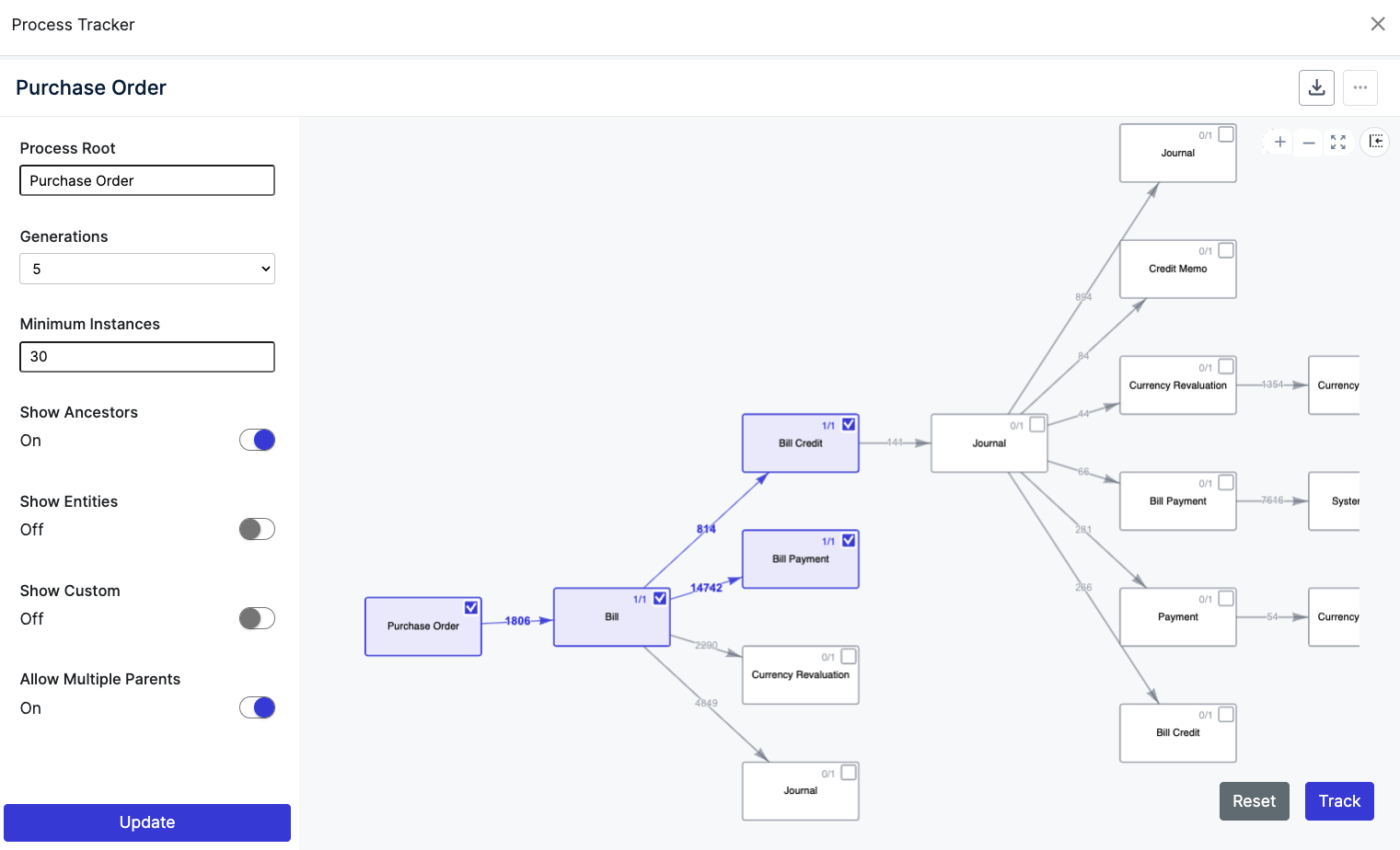

Chassi connected directly to Kappa’s NetSuite and Salesforce environments, completing implementation in under an hour. Within two weeks, Chassi delivered a working capital assessment that required less than five hours of time from Kappa’s internal teams.

Chassi modeled the entire Order-to-Cash and Procure-to-Pay processes across all subsidiaries, and segmented the data multiple ways, including across geographies, terms, and key accounts.

Key Findings

Millions of $$$ in working capital improvement

- A grand total of $7.4M in free cash flow opportunity was identified across multiple working capital improvements.

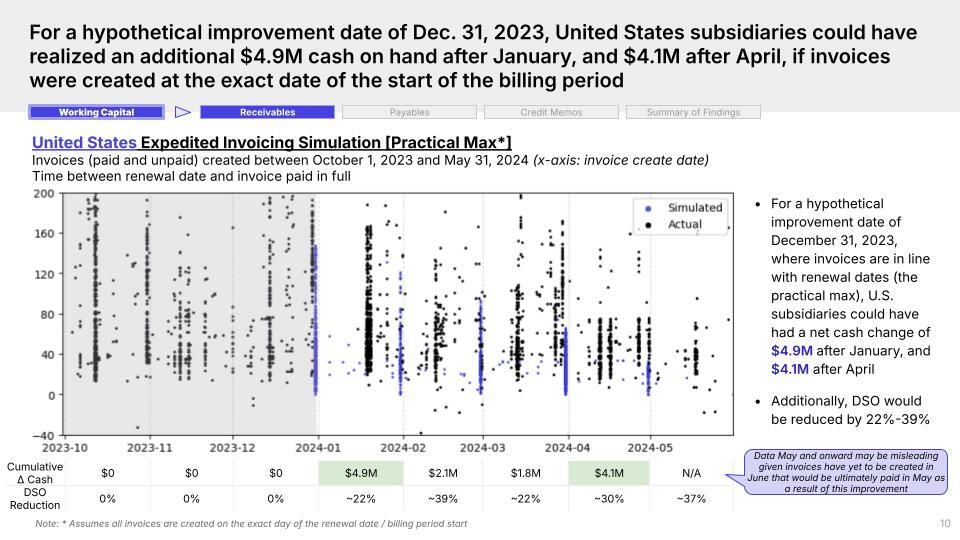

- Delayed invoicing was the primary driver, especially in the U.S., where billing lags resulted in ~$4.9M of trapped cash; freeing up this cash would also reduce DSO by over 20% in the first month.

- In other countries, billing lags resulted in ~$2.3M of trapped cash.

- By pushing back payments of Net 30 payables, Kappa would unlock ~$210K in free cash flow.

- Credit memo usage was inconsistent and not always clear ( e.g., no associated reason code), creating opacity in real cash realization.

Why It Mattered

Enterprise-wide visibility into working capital

- Chassi delivered enterprise-wide visibility into working capital performance, with zero manual data stitching.

- Finance and operational teams could see precisely where and why cash was getting stuck or going out the door before it had to.

- The insights were delivered in weeks, not months, and formed the basis for a focused cash acceleration initiative ahead of the exit.

The Outcome

$7.4M in free cash flow

Kappa Corp. left the engagement with a clear roadmap to unlock $7.4M in free cash flow, with no need for a full-scale transformation or new tooling.

Traditional consulting project approaches would have taken months and cost significantly more, often with limited visibility and unclear ROI. Chassi delivered sharper insight, faster execution, and measurable outcomes in a fraction of the time and cost.

Ready to see these results for yourself? Let’s start with a conversation.

Schedule your personalized demo today: