Your cash is tied up in your processes

When the path from Lead-to-Cash isn’t visible end-to-end, liquidity gets trapped. Variability creeps into DSO, handoffs multiply, and terms and approvals drift from policy, pushing collections out and pulling disbursements forward.

What trapped value looks like in cash conversion:

Invoicing lags that inflate DSO

Booked ≠ billed ≠ paid variance

Early payments on Net 30 terms

Credit memos without clear reason codes

Manual rework and long approval chains

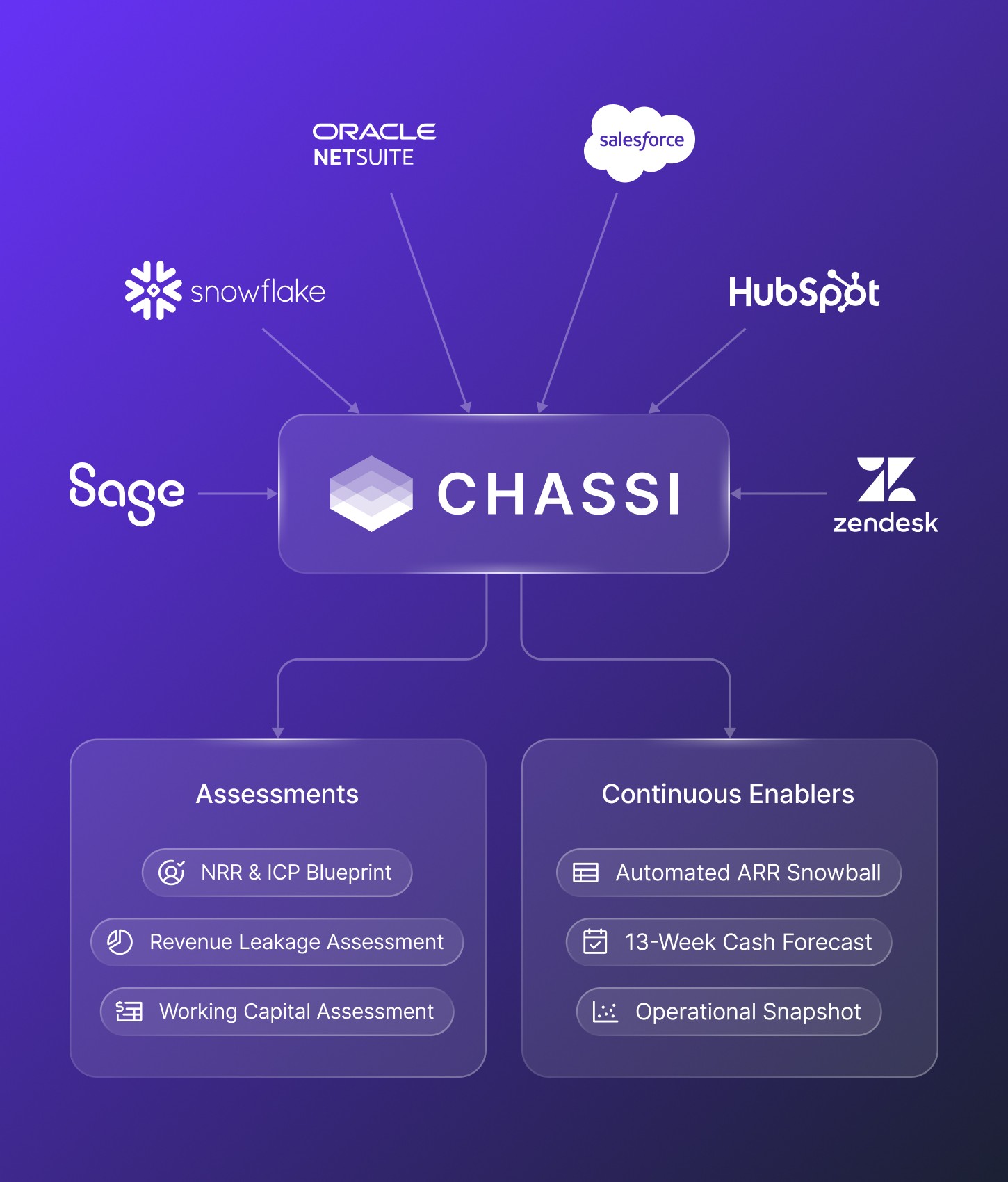

Get clarity in days. Chassi shows where cash gets stuck across L2C and P2P, what it’s worth, and the fastest fixes to move. No manual data prep. No system changes.

One operational truth you can run on

A prioritized 2x2 (value vs. complexity) of actions to free up cash

DSO Simulator outputs that tie steps to measurable cash impact

Terms optimization recommendations with dollar impact by vendor and segment

Clear, actionable insights to improve working capital

Reduce DSO by tightening invoicing and approvals

Standardize billing and collections across entities

Align payment timing to policy and cash needs

Fix exception patterns that create rework and leakage

Objective finding with quantified impact

AR, L2C, and AP P2P happy-path maps and variance analysis

Booked-to-billed-to-paid lineage and exception tables

Terms analysis and payment-timing scenarios

DSO Simulator workbook and scenario notes

Work analysis on key steps (manual changes, scripting issues)

A prioritized backlog with owners and a 30, 60, 90 plan

Real-world impact

A PE-backed enterprise data platform used Chassi to model L2C and P2P across seven subsidiaries. Findings in two weeks with under five hours of internal time.

$7.4M in free cash flow identified

~$4.9M trapped in U.S. billing lags

~$2.3M trapped in international billing lags

$210K unlocked by aligning payment timing to Net 30

Credit memo inconsistencies flagged for policy and reporting fixes

Proven results. Rapid insights. Minimal disruption.

Objective findings with quantified impact for cash, NRR, and profitable growth.

Actionable intelligence, fast

Findings in days tied to cash and NRR.

Minimal lift

Hours, not weeks. No manual data prep.

Strategic clarity

One operational truth that holds up in board and diligence.

Finance-grade trust

Lineage from booked to billed to paid with audit trails.

Empower your profitable growth strategy with Chassi

Clarity in days with read-only connections and minimal lift.