Is revenue slipping through the cracks?

Leakage erodes margins and clouds the exit story. Without a clean link from contract to invoice to cash, underbilling and process errors go unseen.

What trapped value looks like in leakage:

Booked ≠ billed ≠ paid variance that hides in reporting

Missed uplifts, unbilled items, and pricing overrides

Credit memos without reason codes that mask true realization

Manual steps and approval loops that create invoicing delays

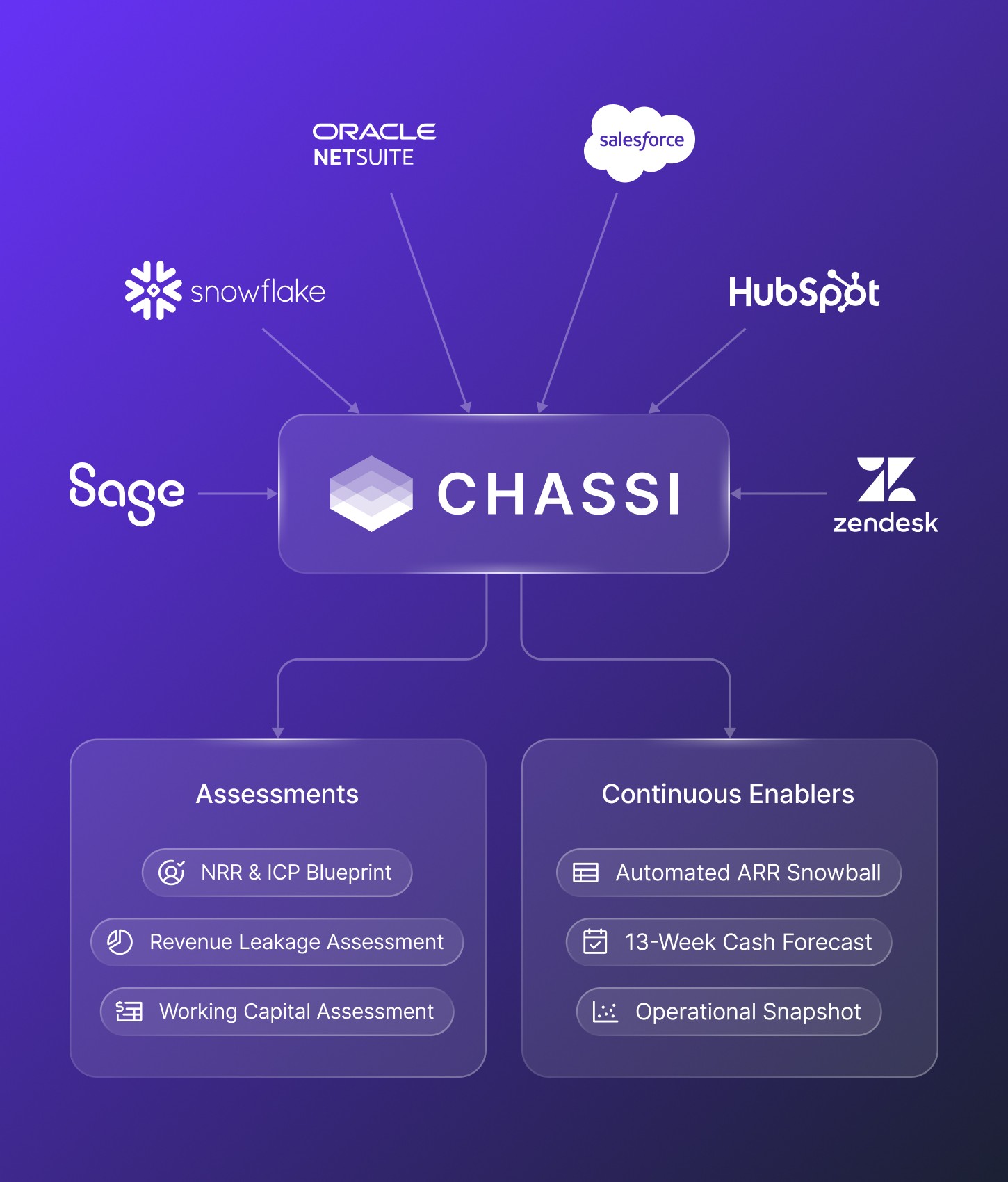

Get clarity in days. Chassi reconciles booked → billed → paid, quantifies leakage by unit and segment, and delivers a plan to recover it and prevent it going forward. No manual data prep. No system changes.

One operational truth

you can run on

A leakage calculator sized by product, segment, and terms

CRM↔ERP reconciled mappings and booked → billed → paid lineage

A prioritized backlog and 30/60/90 with owners and expected impact

Clear, actionable insights to stop and prevent revenue leakage

Identify underbilling, missed uplifts, and unbilled items

Quantify credit memo drivers and tighten governance

Standardize billing policies and approval paths to reduce rework

Measure time-to-bill and its impact on cash and revenue realization

Objective findings with quantified impact

Reconciled contract-to-cash tables and exception lists

L2C leakage dashboard with variance by entity and segment

Billing policy fixes and approval flow recommendations

Leakage calculator workbook and scenario notes

Real-world impact

See how a PE-backed company used Chassi to reconcile contract-to-cash, identify underbilling and missed uplifts, and deliver a plan to recover $21M in revenue across business units.

Proven results. Rapid insights. Minimal disruption.

Objective findings with quantified impact for cash, NRR, and profitable growth.

Actionable intelligence, fast

Findings in days tied to cash and NRR.

Minimal lift

Hours, not weeks. No manual data prep or system changes.

Strategic clarity

One operational truth that holds up in board meetings and diligence.

Finance-grade trust

Lineage from booked to billed to paid with audit trails.

Ready to stop revenue leakage?

Start with a targeted assessment and get a plan to recover revenue and protect margins.